The Central Government may direct any class of companies engaged in production of such goods or providing such services as may be prescribed to include in the books of accounts particulars relating to utilization of material or labour or such other items of cost. Further the Central Government may also direct the audit of cost records of the company.

The Companies (Cost Records and Audit) Rules, 2014 are applicable to every company registered under the Act which is engaged in the production of goods or providing services listed in Table-A or Table-B of Rule 3. Different threshold limits have been prescribed in the Rules for applicability of maintenance of cost accounting records and coverage under cost audit.

Pursuant to the provisions of section 148(1) read with Rule 3 of the Companies (Cost Records and Cost Audit) Rules, 2013 every company including foreign companies, engaged in the production of goods or providing services provided in table A and B, having an overall turnover from all its products and services of Rs. 35 Crore or more during the immediately preceding financial year, shall be required to maintain cost accounting records.

Note that Companies which are classified as a micro enterprise or a small enterprise are also excluded from the purview of the rules.

Further Rule 5 states that the company shall maintain cost records for all units and branches in Form CRA-1 for each financial year.

The criteria for applicability of cost audit are different for companies in regulated and non-regulated sector.

Sector

Turnover Based Limits

(Telecommunication, Electricity,Petroleum and Gas, Drugs and Pharma, Fertilizers and Sugar)

Threshold is Rs. 50 crores for all product and services and Rs. 25 crores for individual product or services.

Threshold is Rs. 100 crores for all product and services and Rs. 35 crores for individual product or services.

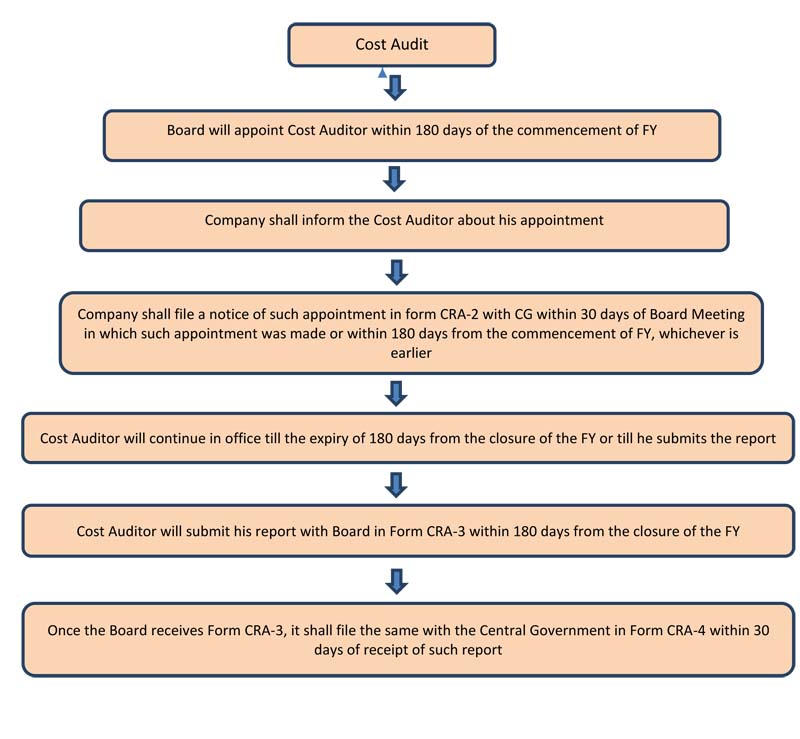

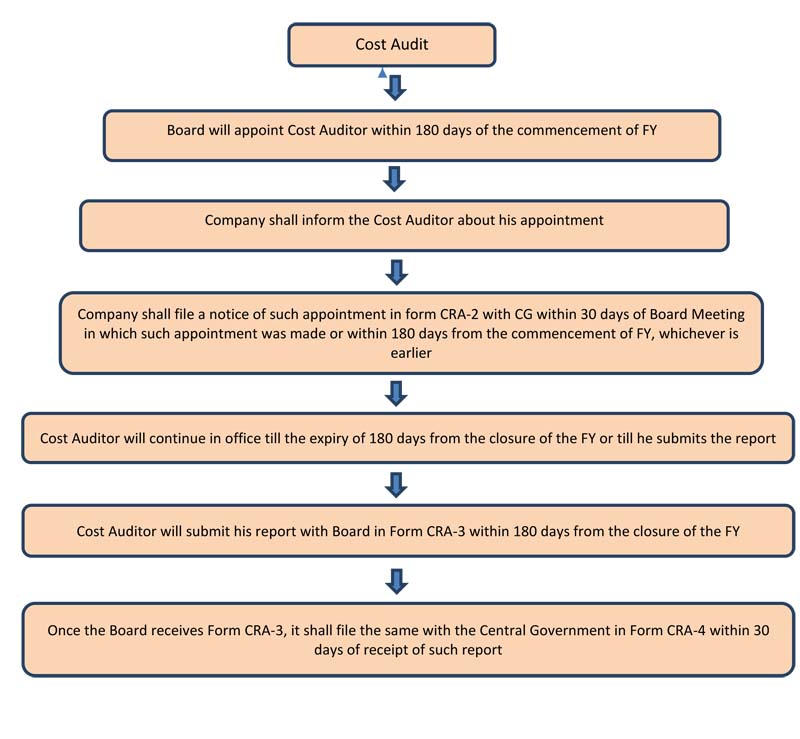

Every company mentioned in Rule 3 and fulfilling the criteria in Rule 4 shall appoint a cost auditor within 180 days of commencement of every financial year. Following can act as cost auditors:

Provided that statutory auditor cannot be appointed as cost auditor of the company.

Cost auditor will be appointed by the board and in case of such companies which has audit committee, then the appointment and remuneration will be recommended by audit committee. The remuneration of cost auditor is required to be ratified by the shareholders.

Once the cost auditor is appointed the company shall inform the Central Government by filing form CRA-2 within 30 days of passing of board resolution or within 180 days of commencement of the financial year whichever is earlier.

The cost auditor so appointed for a financial year shall continue till 180 days from the closure of financial year or till submission of cost audit report for that year.

The cost auditor appointed may be removed from his office before the expiry of his term, by passing a board resolution after giving a reasonable opportunity of being heard to the Cost Auditor and recording the reasons for such removal in writing.

Any casual vacancy in the office of a cost auditor on account of resignation, death or removal shall be filed by the board within 30 days of such vacancy. Once the new auditor is appointed the same shall be informed to Central Government in form CRA-2 within 30 days from the date of appointment.

The cost auditor will conduct a cost audit and prepare a report in form CRA-3 including his reservations, qualifications, observations and suggestions. The cost auditor is required to submit his report to board within 180 days from the closure of financial year. Once the board receive such report, the same shall be filed with the Central Government within 30 days of receipt in form CRA-4

If any default is made in complying with the provisions of this section:

Company and every officer of the company who is in default

Shall be punishable in the manner as provided in section 147(1) - The company shall be punishable with fine which shall not be less than twenty-five thousand rupees but which may extend to five lakh rupees and every officer of the company who is in default shall be punishable or with fine which shall not be less than ten thousand rupees but which may extend one lakh rupees.

Cost Auditor of the company who is in default

Shall be punishable in the manner as provided in Section 147(2) to (4) - If an auditor of a company contravenes any of the provisions the auditor shall be punishable with fine which shall not be less than twenty-five thousand rupees but which may extend to five lakh rupees or four times the remuneration of the auditor, whichever is less

Provided that if an auditor has contravened such provisions knowingly or wilfully with the intention to deceive the company or its shareholders or creditors or tax authorities, he shall be punishable with imprisonment for a term which may extend to one year and with fine which shall not be less than fifty thousand rupees but which may extend to twenty-five lakh rupees or eight times the remuneration of the auditor, whichever is less.

Also, If an auditor is convicted under sub-section (2), they are required to:

(i) Refund the remuneration they received from the company.

(ii) Pay damages to the company, statutory bodies or authorities, members, or creditors of the company for losses resulting from incorrect or misleading statements in their audit report.

The Central Government will designate a statutory body, authority, or officer through a notification to ensure prompt payment of damages. This body, authority, or officer must report to the Central Government regarding the payment of damages in the manner specified in the notification.

If an audit firm is found to have acted fraudulently or colluded in any fraud related to the company, its directors, or officers, the liability (whether civil or criminal) will rest with the concerned partner or partners of the audit firm, as well as the firm jointly and severally.

However, in the case of criminal liability of an audit firm, the individual partner(s) involved in fraudulent acts or collusion will be liable for liability other than a fine.

The author can also be reached at csneharedekar@gmail.com

Disclaimer: Please note that the above article is based on the interpretation of related laws, which may differ from person to person and is not a legal advice.