On Friday afternoon, the Coronavirus Aid, Relief and Economic Security (CARES) Act passed the House of Representatives by a voice vote. The President then signed the bill into law. The bill builds upon earlier versions of the CARES Act and is intended to be a third round of federal government support in the wake of the coronavirus public health crisis and associated economic fallout, succeeding the $8.3 billion in public health support passed two weeks ago and the Families First Coronavirus Response Act. It is the product of negotiations between Democrats and Republicans for a bipartisan response to the crisis.

The CARES Act builds on the two former pieces of legislation by providing more robust support to both individuals and businesses, including changes to tax policy. The bill includes:

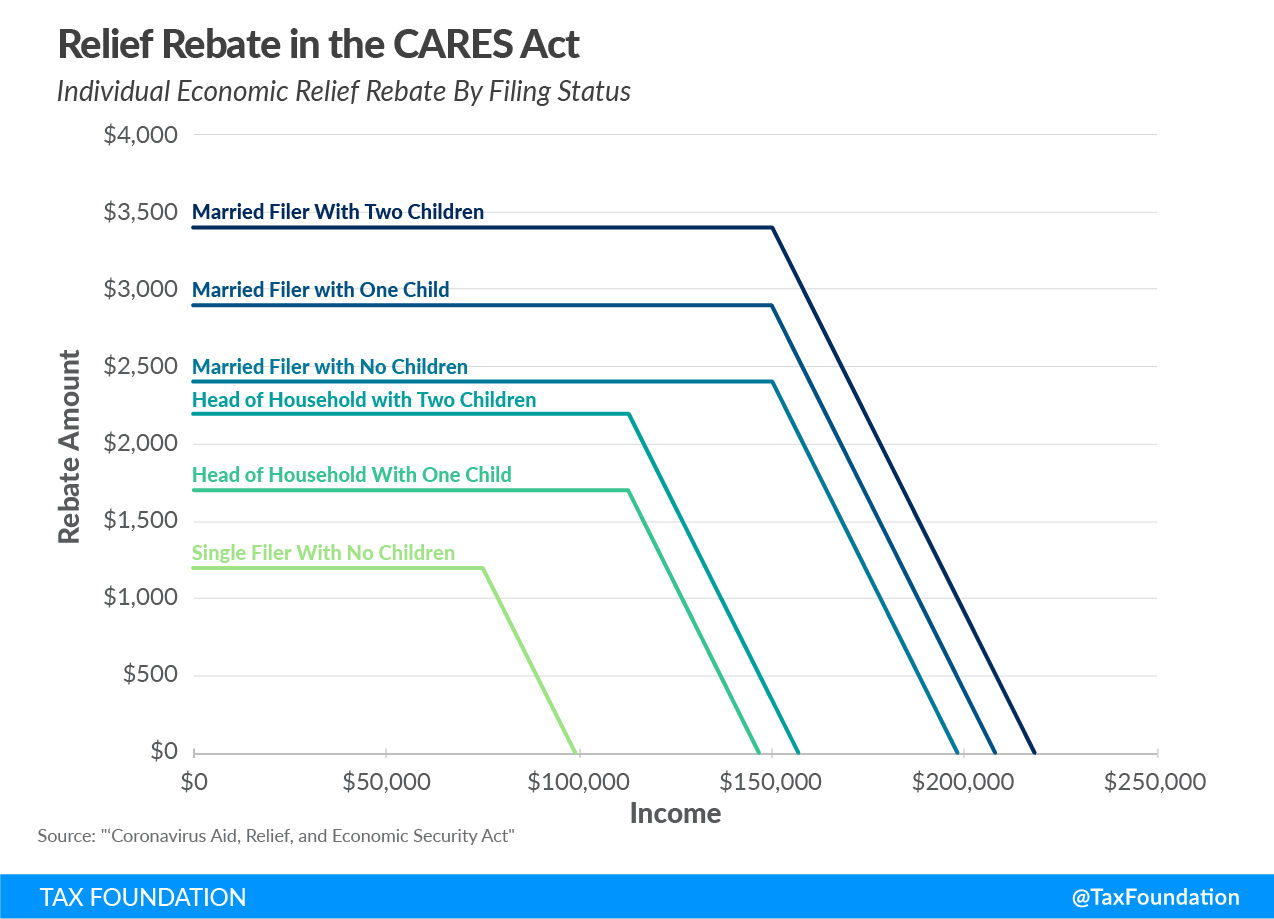

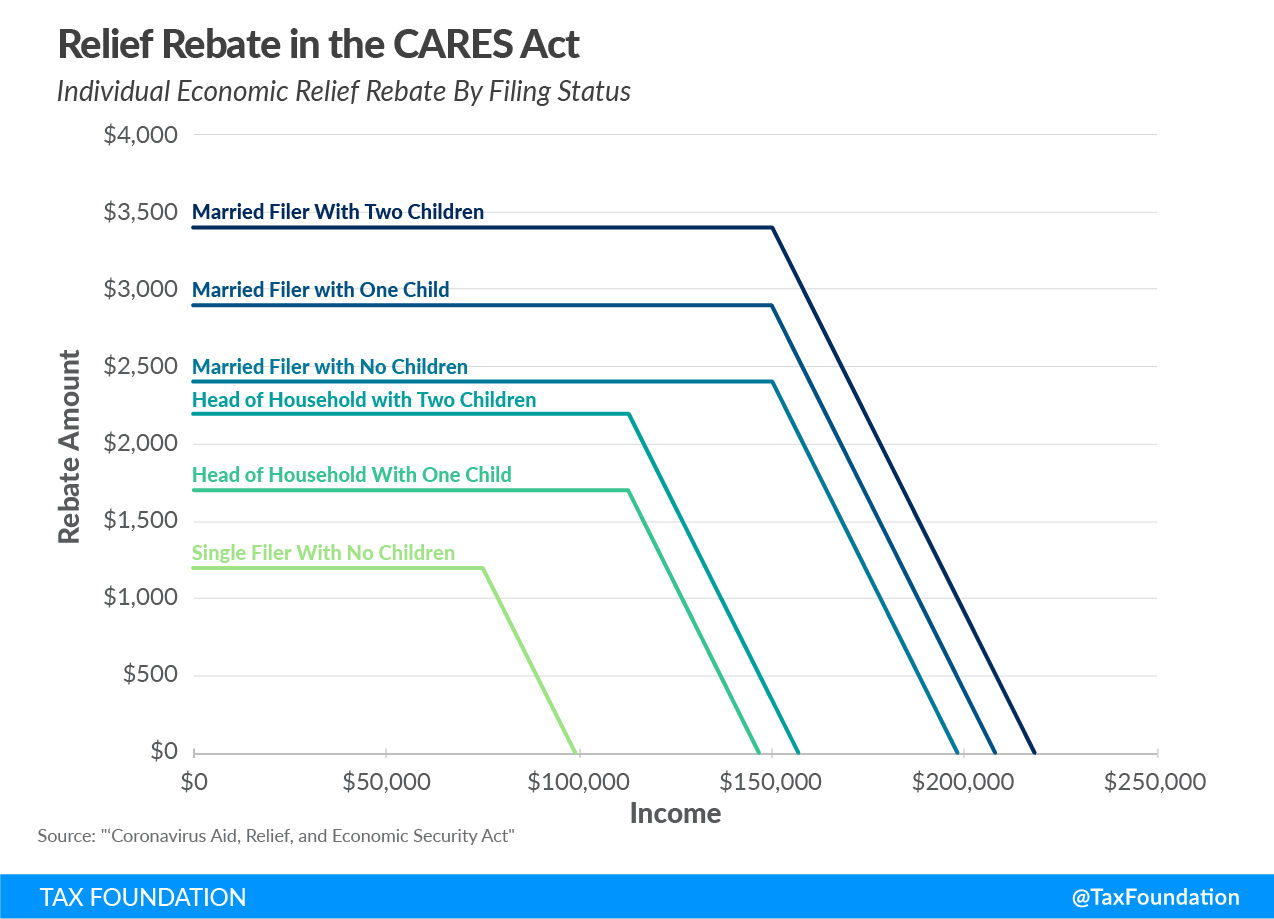

We estimate that the rebates would increase taxpayer after-tax income by about 2.59 percent, ranging from 16.33 percent at the lowest quintile and dropping to 1.89 percent for the 80 th to 90 th percentiles. The rebate is structured progressively but is not available to those who have not filed taxes. These non-filers tend to have lower incomes. Additionally, Social Security Administration benefit information may be used for low-income taxpayers solely relying on Social Security benefits.

We estimate that nearly all filers below the 80 th percentile will receive a rebate, but only 0.1 percent of filers above the 99 th percentile will receive a rebate due to the rebate phaseouts. The average rebate will be about $1,523, ranging from $1,436 for the 0 to 20 th percentiles to $45 for the 95 th to 99 th percentiles.

Source: Tax Foundation General Equilibrium Model, November 2019.

The CARES Act is a positive step forward to provide economic relief to individuals and businesses facing hardship or economic ruin due to this crisis. However, several aspects of the proposal can be improved.

The recovery rebate design has improved, as both the minimum income requirement and phase-in have been eliminated. Policymakers have opted for the design used in the 2001 rebate for distributing the recovery rebates, forgiving any overpayment to taxpayers when they file their 2020 tax returns. This simplifies the design and minimizes the need to claw back rebates later.

As my colleague Jared Walczak has pointed out, state and municipal governments that have allocated funding toward addressing coronavirus concerns in their most recent budgets may not be able to use Coronavirus Relief Fund revenue for those expenditures. Policymakers should consider allowing states and municipalities more flexibility to use relief funds for coronavirus-related expenditures they planned in their budgets to date.

The business provisions improve a firm’s ability to remain liquid and survive through the crisis, but more could be done given the scale of the challenge. In addition to providing NOL carrybacks for five years and suspending the net income limitation, policymakers could permit firms to accelerate the NOL deductions they currently hold, ensuring firms that did not make large profits in previous years also benefit. Additionally, the net interest limitation could be suspended entirely for this tax year.

Some of the tax provisions in the bill, such as the partial above-the-line deduction for charitable contributions, are not tailored to addressing the public health crisis or economic downturn and should be reconsidered. This will keep the bill narrowly focused on addressing the problem at hand and separate long-term legislative decisions from emergency measures needed to provide short-term economic relief.

We are optimistic that policymakers can build on this bill to ensure individuals and businesses can weather the storm and rebound effectively when the crisis abates.

Subscribe to get insights from our trusted experts delivered straight to your inbox.